How Is the Housing Market — Really?

While media headlines focus on the short supply of homes for sale and continued strong demand, there can be a false assumption that the housing market is robust — but it’s not that simple. Home prices remain at historic highs, and even though interest rates have inched downward, homeowners with low mortgage rates aren’t eager to give those up to buy a new home at a higher rate.

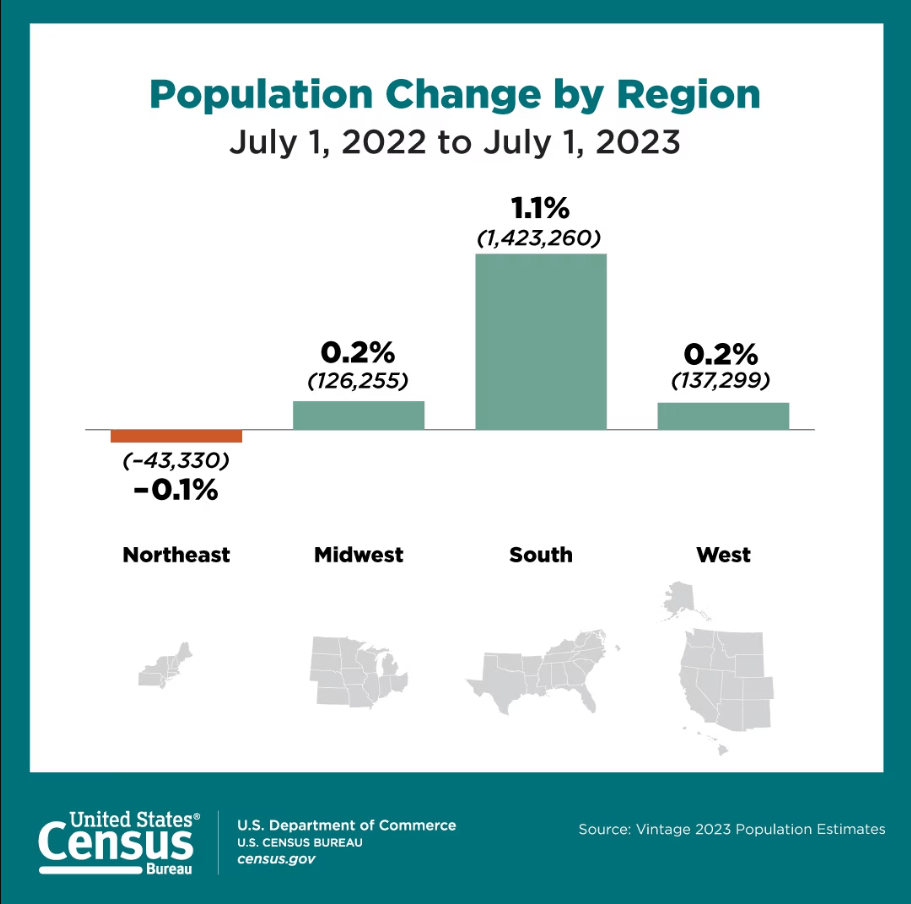

At the January Lightovation show in Dallas, where lighting distributors from all over the U.S. gather to purchase new lighting for their stores, how confident they felt about 2024 depended on where they are located. Lighting reps and showrooms in the Northeast, for example, were less optimistic about a strong 2024 versus those in the South and portions of the West, where business has been steady and strong with no signs of slowing.

As indicated by a late December report from the U.S. Census, the South continues to lead in population, accounting for 87% of the nation’s growth in 2023. “The South is the only region to have maintained population growth throughout the COVID-19 pandemic,” the report said.

The Census also noted that the West has expanded, with Alaska and New Mexico regaining population after experiencing a decline in the previous year. And although California, Oregon, and Hawaii were among the eight states that saw a drop in population for 2023 – Illinois, Louisiana, New York, Pennsylvania, and West Virginia were the others – those 2023 rates have slowed compared to 2022.

There are two other factors that come into play when lighting dealers are evaluating the prognosis for 2024: how much business they do with single-family builders and the multifamily housing sector.

For lighting showrooms located in the South and portions of the West, both single-family homebuilding and multifamily housing provide consistency and volume. Texas – which has attracted large companies such as Oracle, Hewlett Packard, and Charles Schwab, among others – as well as those states identified as the “battery belt” for manufacturing EV batteries (Georgia, Kentucky, and Michigan) are offering the best opportunities for lighting distributors aligned with single-home and multifamily builders as these businesses attract more workers from out of state to settle in these growth areas and there is a scramble to rapidly build housing to accommodate them.

During the pandemic, lighting showrooms saw a boost in business from individual homeowners who directed their stimulus dollars into renovating and decorating their homes. Sales of chandeliers, pendants, table lamps, rugs, wall art, and furniture reached enviable levels. Four years later, however, those furniture and lighting purchases are considered “new” enough by consumers to not need replacing, and instead they are funneling their discretionary income on “experiences,” splurging on big concert events, exotic travel, fine dining, and hobbies.

Most lighting showroom owners at Lightovation agree that they don’t expect sales in 2024 to match the pandemic levels they enjoyed; however, even some manufacturers are noticing a “softening” in the market, by as much as 20 percent. These observations were not from companies that offer high-end luxury lighting designs (a portion of the market that continues to be very strong nationwide regardless of economic conditions) nor ones that rely on builder business. Instead, it’s an observation shared by some manufacturers of decorative lighting and accessories in the mid-to-upper-end of the market. It is that mid-to-upper-end customer who was doing a lot of the pandemic purchasing, sprucing up their environments as they hunkered down in quarantine.

The National Association of Home Builders (NAHB) has a favorable view of 2024. “Single-family starts are expected to grow in 2024, adding much needed inventory to the market. However, builders will face growing challenges with building material cost and availability, as well as lot supply,” said NAHB Chairman Alicia Huey, a custom home builder and developer from Birmingham, Alabama.

Added NAHB Chief Economist Robert Dietz, “Mortgage rates have decreased by more than 110 basis points since late October per Freddie Mac, lifting the future sales expectation component in the HMI (Housing Market Index) into positive territory for the first time since August. As home building expands in 2024, the market will see growing supply-side challenges in the form of higher prices and/or shortages of lumber, lots, and labor.”

Exurban areas posted the largest increase in market share for both single-family and multifamily construction, according to the latest findings from the NAHB Home Building Geography Index (HBGI) for the third quarter of 2023.

Huey noted, “The HBGI report shows the multifamily sector continued to post strength in two geographic areas: large metro outlying counties posted a ninth consecutive quarter of positive growth while non-metro/micro counties registered positive growth for the 11th straight quarter.”

According to lighting distributors at Lightovation who do business in the multifamily sector, they are expecting that category to continue to perform well in 2024.

Freddie Mac’s 2024 Multifamily Outlook states, “Assuming we achieve an economic soft landing, we believe the multifamily market will continue to see slow growth while it works to absorb the high level of new supply in 2024. As the overall economy slows leading to a softer labor market, multifamily demand is expected to remain positive, but weaker compared with pre-pandemic rates.”

The report goes on to say, “If the economy does not achieve the soft landing and instead falls into a recession, the multifamily market would likely see meaningfully lower market performance. Regardless of economic conditions, the pipeline of multifamily units expected to be delivered this year is extremely high, and if demand is lowered due to a recession, the overall multifamily market would face additional upward pressure on vacancy rates and downward pressure on rents…but slower rent growth and the higher rate environment may continue to suppress multifamily valuations in 2024…over the longer-term, the multifamily market will continue to be supported by the overall shortage of housing, an expensive for-sale housing market, and the next generation of renters (Generation Z) entering prime renter age.”

In general, the mood among lighting manufacturers, distributors, and lighting representatives at Lightovation is cautiously optimistic for 2024. Those located in the South and parts of the West report plenty of projects in the pipeline for much of the year, and those in the Northeast and Midwest are hoping for some modest growth now that interest rates have stabilized and do not appear to be in danger of rising in the near future.

The decorative lighting manufacturers who exhibited at Lightovation brought out an assortment of fresh products in an array of designs that lighting distributors said would sell well with their customers. Years ago, it was easier for manufacturers to determine how well new items were selling or what sort of year it would be, based on the amount of orders taken at Lightovation. However, slowly over the last 8 years or so, more distributors are holding off on placing orders at the show and are instead making their final decisions sometimes up to two months after the show ends, after much evaluation over their budgets and greater involvement of their sales staff as to which items they think would sell best.

Related articles