Contractors, Architects & Designers Share Insights in the 2025 Houzz State of the Industry Report

The 2025 U.S. Houzz State of the Industry report – compiled from survey results submitted by 1,537 American residential renovation businesses listed on Houzz – indicates a positive outlook that mirrors the sentiment recently expressed among lighting showrooms, home builders, architects, and kitchen/bath dealers at the January trade shows.

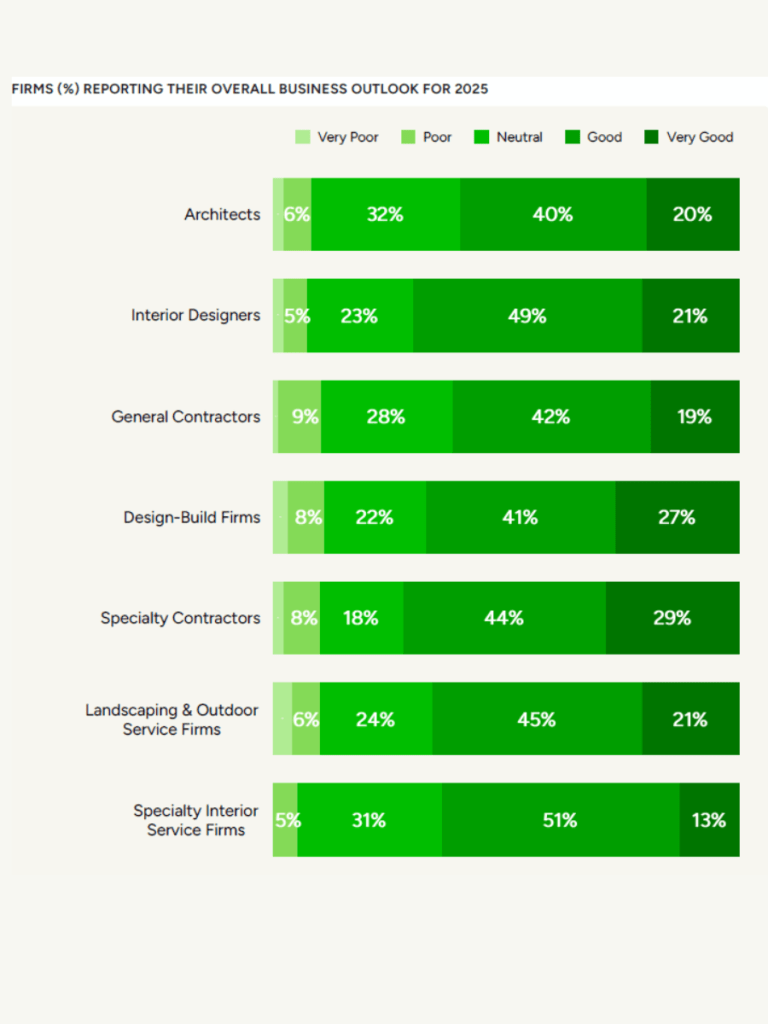

According to the report, three out of every five firms in the construction and design sectors have a positive business outlook for 2025 — with 60% to 73% reporting having a “good” or “very good” outlook. The optimism is most widespread among specialty contractors, with nearly three-quarters (73%) reporting having a “good” or “very good” outlook for 2025. Interior designers follow closely, at 70%. Sentiment is also positive among the majority of design-build firms (68%) and general contractors (61%). Architects are the most conservative group, with 60% having a “positive” outlook and nearly a third (32%) reporting having a “neutral” outlook.

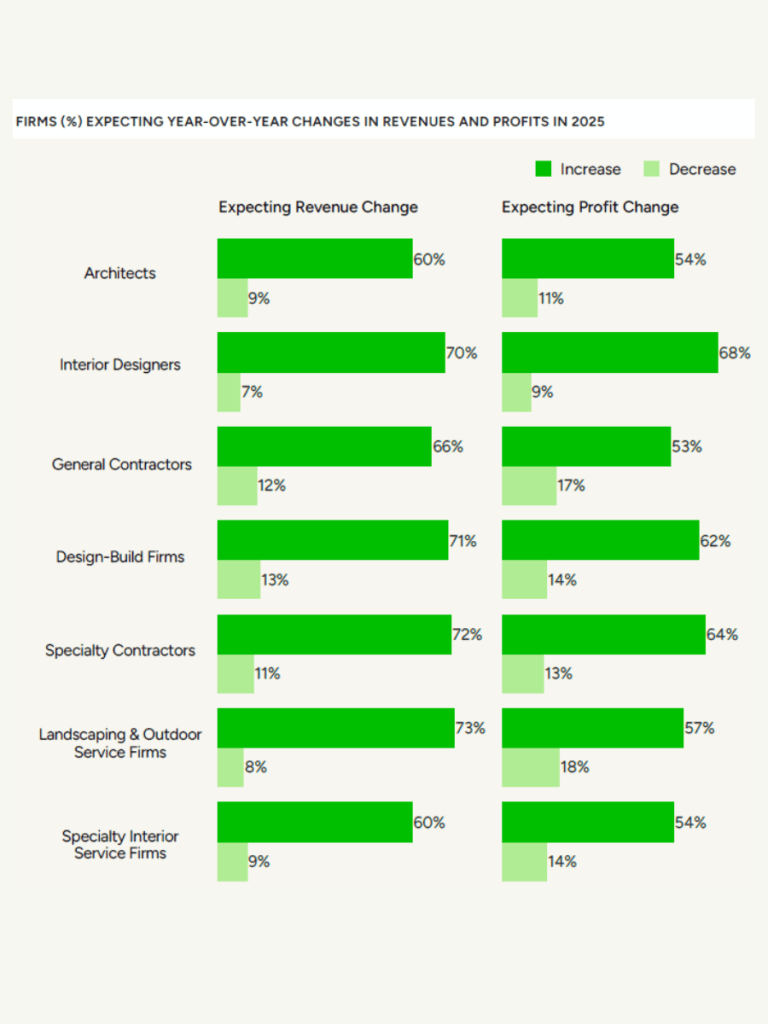

Now that the election year angst is over, more firms in both the construction and design sectors expect the national economy and their local economies to improve, with more than half (51% to 77%) anticipating a higher demand for their services in 2025.

The year in review

This is welcome news when compared to 2024’s business climate, in which businesses across all industry groups reported the biggest year-over-year dip in average annual revenue since 2014. Revenue for business providing specialty interior services dropped by 7.2%, followed by a decline of 6.5% for landscaping and outdoor service firms. In the construction sector, both design-build firms and specialty contractors reported a 2.8% decline in 2024 revenue compared with the previous year, while general contractors experienced a smaller drop (0.3%). In the design sector, interior designers experienced the largest revenue dip (4.1%), while architects reported a 2.4% decrease.

Where they’re spending

Companies participating in the survey say they are investing in tools that can help them increase efficiency — with 42% of specialty contractors and 40% of design-build firms dedicating resources to streamline processes and improve productivity. Approximately 20% of architects, 16% of interior designers, and 16% of design-build firms are focused on “maximizing returns on existing technology investments.”

The surveyed businesses indicated that they use software to manage projects and operations, engage clients, automate workflows, facilitate payments and enhance brand visibility. Specifically, 84% of architects, 58% of interior designers, 57% of design-build firms, and 51% of landscaping and outdoor service firms used drafting and rendering software in 2024. Meanwhile, nearly two out of five specialty contractors (37%) and one-third of general contractors (33%) relied on software for estimating costs or bids.

Labor still a concern

According to the survey results, more firms expect labor availability to worsen in 2025 than expect it to improve (29% to 46% versus 13% to 19%, respectively). Among the deviating group, specialty interior service firms, equal shares (17% each) expect more and less labor availability.

The pattern is similar for labor costs. More than half of businesses (51% to 57%) expect labor costs to increase, while fewer than half (48%) of those providing specialty interior services do. In the construction sector, the expectation that labor costs will rise is most prevalent among specialty contractors (57%), followed by design-build firms (56%) and general contractors (51%).

Download the full report here