4 Unexpected Metrics to Prepare an Economic Forecast for Your Lighting Business

Did you know that there are free tools accessible to everyone that can help you prepare for the business challenges ahead?

At last month’s American Lighting Association Conference (ALA) in Palm Beach, keynote speaker Gene Marks provided a tailored economic forecast for lighting manufacturers and distributors and shared the resources that he relies on for guidance.

Marks, a practicing CPA, writes on the economy for such renowned publications as The Washington Post, The New York Times, The Hill, and Forbes, Inc. and has interviewed more than 1,00 business owners, leaders, managers, and executives in different industries on their business practices.

“There is one thing they all have in common: They are always looking ahead,” Marks said. “Their minds are on 2025, 2026, and 2027 — and that’s where our minds should be. We have to be thinking two and three years ahead.”

According to Marks, if you want to know where the economy is going and how it is currently performing, it’s better to follow actual data from real organizations and companies rather than relying on government reports such as GDP and Unemployment statistics.

Here, he shares the four key metrics that he uses when assessing the economy:

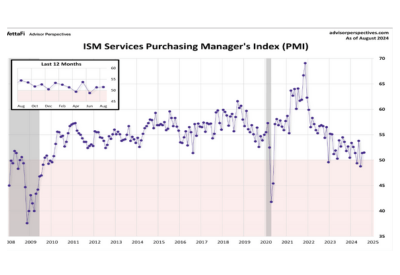

1. “I like to look at the Institute of Supply Management (ISM), which is a trade association of purchasing managers,” Marks stated. The Institute of Supply Management: Mfg and Services section is the most appropriate resource for the lighting industry.

2. Marks recommends the National Federation of Independent Business (NFIB) and its Small Business Optimism Index. The NFIB also offers Small Business Economic Trends data through its quarterly surveys.

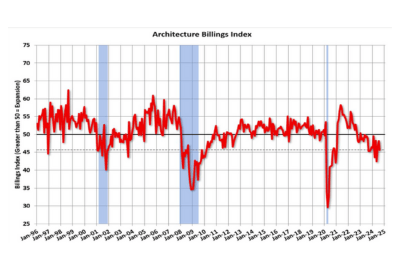

3. Marks also follows the American Institute of Architects’ Billing Index, which provides the metric for the real estate construction industry. “You want to follow this index right now. It will tell you what residential and commercial building is doing over the next six months or so,” he explained. “You are going to see this index go up as mortgage rates come down and people start designing their buildings and laying out homes. I’s a great index to follow for the real estate industry.”

4. Freight is another measurement to keep an eye on. “When it comes to shipping overseas, the indexes to watch are going to be a little bit different. The Baltic Dry Index is a measure of freight that is shipped through the Baltic Sea, which is one of the world’s most traversed freight lines for shipping. When that index is up, it means there is more competition for freight, which means the global economy is doing well,” he stated. “The index was [significantly] up post-pandemic, as shipping lines were trying to meet demand. Right now, like all of these other metrics, it’s at a level of mediocrity. I’m not expecting to see that change that much, but if you start seeing that tick up higher, that means the global economy is starting to heat up, which is a good sign.”

In addition to those metrics, Marks also follows the earnings reports shared by large companies such as the major banks (Chase, Capital One), retailers (Walmart, Amazon), and payroll services such as ADP’s National Employment Report and Paychex Small Business Employment Watch.

In explaining his information-gathering process, Marks noted, “We live in a capitalistic society, so if you want to learn about capital, that leads you to the big banks. How are they doing? We also live in a consumer-driven society, so you want to find out from the retailers whether people are buying. And we live in a society that needs jobs, so we want to find out from the recruitment firms what is going on, because that is real data.”

For example, Marks noted that consumer banking loans were down $1.6 billion, banking revenue in the last quarter was down about 9%, and delinquency rates were up. “This is not a catastrophe, but it is evidence of a mediocre economy right now,” he stated.

After following those metrics, Marks predicted that the economy will pick up midway through 2025 as interest rates come down again. “I think the magic number for mortgage rates will be 5%. I think that’s when you’re going to see a lot of difference in the lighting industry.”