New Synergies in PropTech Boost Revenue Stream for MDUs

February 5, 2022

February 5, 2022

The shortage of single-family homes – which faced a supply issue due to labor shortages even before the pandemic – has led to unprecedented demand in multi-family housing or, as it also known, MDUs (multi-dwelling units).

According to a report by Bloomberg in January, “New U.S. home construction unexpectedly strengthened in December to the fastest pace in nine months, led by apartment projects…multifamily starts – which tend to be volatile and include apartment buildings and condominiums – climbed 10.7% to a 530,000 rate, the fastest since February 2020.”

The multifamily residences being built and retrofitted these days feature amenities that weren’t on anyone’s radar 10 years ago — and those innovative developments are providing property owners and managers with new revenue streams.

At the 2022 edition of the Consumer Electronics Show (CES), Kristen Hanich of Parks Associates, asked a panel of experts – Jennifer Doctor of JCI (Johnson Controls); Sean Miller of Griot Technology; Blake Miller of Homebase; and Wannie Park of Zen Ecosystems – to share their observations and predictions regarding this burgeoning market space.

Top Trends

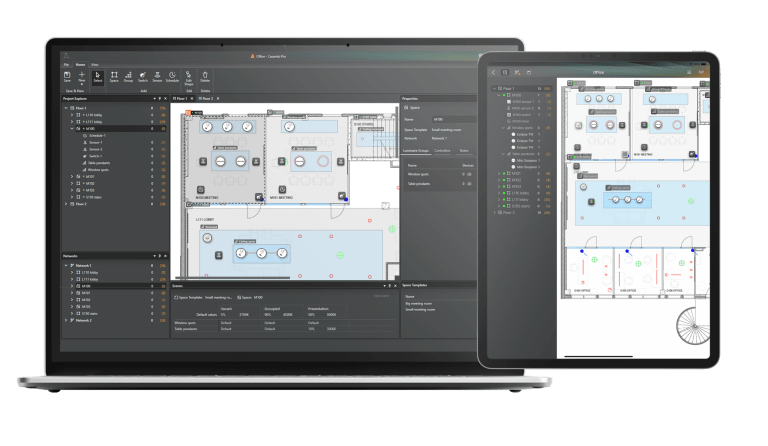

“In the multifamily market, PropTech is what’s happening now,” noted Blake Miller, CEO of Homebase. “The internet infrastructure is one of the most important things outside of access control (getting people in/out of the building). The ideal scenario is to use this common infrastructure to not only connect all of the devices that will go in the building, but also be able to use it to resell to the building’s residents as both an amenity and a revenue generator for property owners.”

Sean Miller, CEO of Griot Technology, added, “We have been talking about smart homes at CES for several years. We’re at this phase of ‘How do you take the old non-connected dumb buildings and stage them across to the smart cities?’ At first, we had [the connectivity of broadband]. What’s getting added in now is the hardware and services that help those connected buildings become smart — and smart not only in how they’re maintained and managed, but also how they’re built and financed.”

Jennifer Doctor, Senior Director/Product Management for JCI, observed, “We look at MDUs as the next market of growth. It’s no different than a single-home residence or commercial property. What we need to look for in the MDU space are solutions that provide the same value that you’re getting in a single-family residence smart home. If you’re going after the current millennial MDU environment – and let’s face it, that’s the generation that’s going into that market – you’re looking at which services are attractive. In my opinion, in order to be successful in MDU you need the ability to blend [hardware and software] into a net zero footprint.”

Wannie Park, CEO of energy management platform Zen Ecosystems, remarked, “What we see is large real estate companies and property managers starting to implement ESG or sustainability goals, but it’s not so easy. You could retrofit an entire building, but the CPAEX (capital expenditure) would be crazy. What we try to do is integrate with every regulatory entity or utility commission, let’s say by state, and we integrate with the Independent System Operators (ISO) and Regional Transmission Organizations (RTO), the folks who operate the grid.” Zen Ecosystems then performs a variety of analytics for its customers. Park said, “A lot of customers will tell us, ‘I don’t know how to do this, but I have an energy mandate. Can you help?’” He noted that large global property management companies such as Greystar and Blackstone are already setting energy mandates for their buildings.

While the technology – smart thermostats, lighting, locks, and security – might be similar for single-family residences and multi-family, there are significant differences. For example, selling a single-family residence on smart products has just one customer involved. In the MDU arena, there are multiple “customers” you need to sell on implementing a smart system, such as the property owner, property manager, general contractor, asset manager, and even the developer.

“There are so many entities that touch a building,” Blake Miller remarked. “Retrofits are easy because you have those three customers: the property owner, the property manager, and the resident. But if you’re building from the ground up, those systems become critical infrastructure to get that building off the ground. There are so many other players, and each one of them have their own P&L and how they look at things. They look at how the CAPEX versus NOI (net operating income) is going to play out. Each one of them looks at it from a different lens.”

The Connectivity Conundrum

The idea of integrated community-wide wifi for building residents as an amenity versus private individual networks contracted between the resident and the internet provider has its pros and cons.

“The community-wide wifi aspect sounds really nice, but it falls to what the end-customer needs,” said Blake Miller. We’ve focused on that secure, private network per unit (versus one LAN for the entire building). It may be a little more expensive from a CAPEX perspective, but it provides a much better resident experience and ultimately allows the property owner to generate more revenue. Other spaces in the building can still have resident or guest wifi.”

Doctor concurred, adding, “You can only differentiate so much based on the appliances, cabinets, and how many bedrooms and bathrooms you have; that’s a finite list. What you’re going to start seeing is differentiation regarding the value and services — and that’s where the revenue opportunities are, whether through community-deployed software or individual unit software. The true value is going to come out of deploying the revenue while decreasing your costs. You can decrease your cost if you’re enabling smart decisions, like if I walk out of my condo and a sensor knows I’ve forgotten to turn my lights off, so the unit turns them off. Or the aware ability that if my unit has been unoccupied for eight hours, it needs to decrease my energy. [Connectivity] is going into the power consumption modes of the appliances. We don’t have those tied into our smart residences, but we’re starting to see them in smart buildings. Those value services that extend beyond what you normally are thinking of are where you’re going to see the differentiation in the MDU market.”

Where Is the Demand for Smart MDU Technology?

“Everywhere. Anywhere that’s building,” Blake Miller answered. The area of the country with the most construction activity is in the Southwest through Texas, extending into some of the Midwest, and out toward the West — what many call the “smile” states due to its shape. “The southern half of the U.S. is where it’s growing. I read that there are 440,000 starts scheduled for this year and clearly that’s not enough for how much housing we need,” he said.

Regarding controlling energy costs, Park remarked, “I’ve seen a couple of things driven by the pandemic. One is in this sort of corporate/temporary housing where they don’t have full control and what they’ve seen is occupancy plummet and energy bills flatline or increase. That’s a real issue, and it’s expensive because it’s a common area. The second thing we’ve seen involves homeowners’ associations (HOA), where it’s the same sort of concept, but the energy bills are baked into the HOA dues. They’re trying to figure out not only how do we generate revenue, but maybe there’s a way to reduce cost.”

Community wifi might be one solution. “We’re seeing HOAs looking at this,” Blake Miller commented.

If residents are already spending for individual internet connections, what if that was changed over to community wifi and the amount each unit is spending on broadband goes to the HOA and becomes part of the community’s emergency fund?

Sean Miller pointed out that retrofit opportunities exist for converting office space into MDU. “Last year there were over 150 commercial buildings that were turned into apartments,” he noted. “If this work-from-home trend stays, there are conversion opportunities out there just like we’ve seen [under-performing] shopping malls being transformed into distribution centers.”

How Else Is Tech Bringing More Value?

Now that basic smart tech products such as lighting controls and security have been widely available, what’s the next step for luxury MDUs?

“I think technology has become table stakes in MDU very quickly,” Blake Miller stated. “It’s like having granite countertops and stainless steel appliances. The IoT is already here with smart locks, access control, internet, and smart thermostats. Now it’s about experiences, such as offering in-home grocery delivery or letting residences know when maintenance staff has come to make a repair. It’s creating those new experiences for residents, but also on the property agent side, making their lives a lot easier. Instead of the property manager having to walk around to check 10 units that are between leases and make sure the maintenance crew has turned down the thermostats, they don’t have to do that legwork anymore. [Smart technology] can turn them off every day at five o’clock or make sure the thermostat is not running in a vacant unit. Creating those automations, those killer apps on top of the building’s operating system, are the areas we’re focused on.”

The MDU and single-family markets will be supported in their PropTech growth by the burgeoning smart cities developing around them. According to a recent study by Polaris Market Research, the market size of smart cities on a global scale is expected to reach USD 1.03 trillion by 2028, registering a CAGR (compound annual growth rate) of 14.4% from 2021-2028. Learn more about the study here