DISRUPTION 2.0: How Ready Are You?

December 6, 2021

Last month, guest author Peter Brown introduced the concept of industry disruption as it relates to the U.S. market’s transition from legacy light sources to digitized, LED versions. This second article in a three-part series dives further into the disruptions that will continue to affect the lighting industry.

Last month, guest author Peter Brown introduced the concept of industry disruption as it relates to the U.S. market’s transition from legacy light sources to digitized, LED versions. This second article in a three-part series dives further into the disruptions that will continue to affect the lighting industry.

By Peter Brown

The first of this three-part series on understanding disruption covered the technical aspects of digital disruptive technologies; let’s call it the Why’s of when anything transitions to a digital form. This second article discusses the degrees of acceptance of disruptive technologies by the marketplace.

First, the good news: there is a consistent model that does not depend on the type of technology or the market segment, whether consumer or business. Now the bad news: most sellers in a transitioning industry do not follow this model. It’s business as usual – until it’s not.

In 1991 Geoffrey Moore wrote the book Crossing the Chasm, which detailed new technology going from no sales to mainstream. “Our attitude toward technology adoption becomes significant any time we are introduced to products that require us to change our current mode of behavior or to modify other products and services we rely on,” Moore wrote, adding, “Such change-sensitive products are called discontinuous or disruptive innovations. The contrasting term, continuous or sustaining innovations, refers to the normal upgrading of products that do not require us to change behavior.” Believe it or not, 30 years later, the model he described is just as relevant.

These insights apply to the adoption of LED, controls, IoT, and LiFi.

Crossing the Chasm was written primarily for start-ups with no legacy products to be replaced. Moore also wrote Zone to Win – for existing companies – where legacy products increasingly conflict with a competing new technology. If this seems like a lot of focus on books, it is. Moore’s books were required reading for high tech in the 1990s. The small number of “techies” who moved to lighting with the advent of LED have used Moore’s teaching to their advantage.

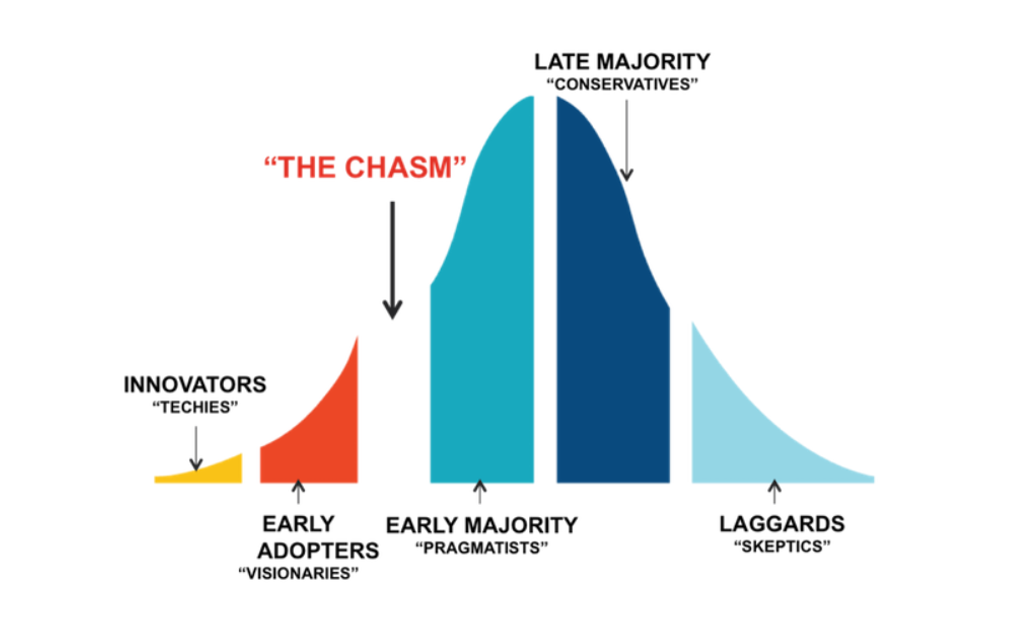

Moore developed a model called “The Technology Adoption Life Cycle,” which is comprised of five distinct groups: Innovators, Early Adopters, Early Majority, Late Majority, and Laggards. The order of these groups never changes. Innovators are always first, Laggards always last. The key to understanding these groups is their attitude toward new, disruptive technologies.

Innovators and Early Adopters buy because of what the technology can do. Innovators look for, embrace, and enjoy new technologies. They accept the bugs, the incompleteness, the changes required to their old methodology. Unfortunately, they represent only 3-4% of businesses.

Early Adopters aren’t as passionate about new technology, but their vision and insights can see the value to their business. They make up 10-13% of buyers. So, approximately 15% of the marketplace buys new technology based on features and benefits. If only the remainder did!

The next group, Early Majority, represents the first large group of buyers, at 35 percent. This buyer is comfortable with technology, but its features and benefits are not the driving force that results in a sale. Regardless of technology, it is a financial transaction. Payback, return on investment, case studies with financial measurements — all are required considerations. Financials overrule features and benefits almost every time, no matter how many ways the features and benefits are presented and no matter how much “educating the prospect” is done. It will not overrule finances for any for-profit organization.

In Crossing the Chasm, Moore describes the changes required when product adoption moves from the first two groups to a third group. Failure to shift discovery questions, marketing, and sales proposals to this unbending rule is the main reason for technologies languishing in the “chasm.” The longer the time, the wider the chasm becomes.

The key requirement to cross-over is establishing a dominant presence in a part of the marketplace. Once established there, the technology starts to become mainstream. This is the Late Majority, which makes up another 35 percent. This group is more conservative in its decision process, preferring to buy from established suppliers and adopting products that the Early Majority continues to use.

This leaves the last 15% – the non-tech group – the Laggards. They don’t want anything to do with any “new-fangled” technology. They only buy when the technology is buried in a product, or the legacy version is no longer sold. They still use a flip phone.

Failure to understand and apply these marketplace principles will result in products being stuck in the chasm, where they will fade away if unable to meet the requirements of the “Majority” groups.

To look at this process from outside the box, let’s take a totally different product. Moore uses the example of the fully electric vehicle (EV). Innovators started doing one-off project cars by replacing fuel engines with electric motors in the 1980s. GM introduced the Volt in the late 1990s, and Tesla’s first vehicle was in 2013. As of 2020, just 2% of new non-commercial vehicle sales in the U.S. were EVs. This year, 2021 is on track for 4%, 20+ years in the chasm.

Where are you on the Disruptive Technology Life Cycle?

Do you own an EV?

Are you considering one if the range is over 500 miles a charge?

Or when there are as many charging stations as gas stations?

Not as long as you can buy a used gas vehicle?

LED lighting that replicates legacy lighting for both residential and commercial spaces has smoothly made the transition from niche markets to mainstream. Financial modeling is simple and easily understood. The benefits of the six Ds of Digitalization (mentioned in the first article) have provided for many innovations not possible with legacy light sources. Combined with exponential growth factors, LED lighting is already reaching majority adoption in residential markets. The same is expected for commercial sites between 2025 and 2030. This rate of adoption is twice as fast as incandescent to CFL or T12 to T8 fluorescents.

Almost all these applications are what Moore refers to as “continuous innovation” — T8 to TLED, MR16 halogen to MR16 LED, 400w MH high-bay to 150wLED high-bay, and 2×4 T8 troffer to 2×4 LED troffer. All stay with the existing distribution model, the same budget line items, the same rebate formats, and the same audit/design/procurement/install procedures.

This brings us to the current state of connected lighting systems. The 2018 Department of Energy report on connected lighting listed adoption at:

2016 – <0.1%

2018 – <0.2%

2021 estimates range from 0.5 to 1.5%.

Why such low adoption when there are ample features and benefits not available before digitalization of lighting? Because it is a disruptive innovation. The more complex the system, the more disruptive.

The final article will look connected lighting systems, using the lessons from the previous two.

______________________________________________________________________________________________________________________

Peter Brown, LC, founded Lighting Transitions in 2018 as a Disruptive Technology Consultant who assists commercial companies in the U.S. transition from legacy lighting to a digitized, LED-based industry.

He is sharing his insight on embracing and profiting from disruption in the lighting industry through an exclusive three-part series for U.S. Lighting Trends.