Commercial Lighting Rebate Outlook for 2024

By Craig DiLouie

March 25, 2024

In 2024, commercial lighting rebates remain a strong incentive for adoption of energy-efficient lighting and controls in existing buildings.

Notable trends in prescriptive rebates include continuing widespread availability, softening demand for rebate dollars, more bonus programs, generally increasing average rebate amounts, and strengthening of networked lighting control rebates.

Rebate Review

Utilities and energy efficiency organizations offer rebates as an investment in reducing electric demand, thereby avoiding the higher cost of acquiring new generating capacity. These programs have traditionally placed a heavy focus on lighting and are primarily targeted to existing buildings.

Prescriptive (downstream) rebates are straightforward but require upfront investment and an administrative process. With this type of rebate, the program incentivizes adoption of energy-efficient lighting and controls by offering a cash amount per qualifying installed product. The rebate is typically awarded to the owner.

While fairly straightforward, an upfront investment may be required, and the process of acquiring the rebate may involve pre-approval and inspection. This is the most popular type of commercial lighting rebate and the focus of this article.

Point of sale (midstream) rebates simplify the rebate but are limited in availability. This subset of prescriptive rebates is distinguished by being realized at the point of sale, such as at a distributor. The result is an instant rebate.

While growing in popularity, typically as a supplement to other rebate types in a mix, these programs are generally limited in terms of qualifying product types. They place a major focus on very common LED products.

Custom rebates can offer big rewards but more complexity. With this type of rebate, the project team proposes an innovative design that goes beyond the prescriptive program. The resulting process is therefore more complex than with prescriptive programs. An example is a rebate based on $/kWh savings.

Regardless of approach, rebates are largely individualized, so if working across programs, one should gain familiarity with individual requirements.

2024 Rebate Trends

Looking at the BriteSwitch Rebate Pro for Lighting rebate database for 2024, we can identify several notable trends for prescriptive commercial lighting rebates.

Rebates continue to be available throughout North America. According to BriteSwitch, nearly 80% of the United States continues to be covered by an active commercial lighting rebate.

A notable development in 2023 was in Ohio. After discontinuing rebates at the end of 2020 as the result of state legislation, it saw the reopening of a commercial lighting rebate offered by FirstEnergy, which covers about a third of the state.

Demand for commercial lighting rebates appears to be softening. Traditionally, demand for commercial lighting rebates achieved a level where funds would run out in the third or fourth quarter of the year in as many as 25% of programs. In 2022, fewer programs ran out of funding. In 2023, this happened again in what may be a strengthening trend. Last year, only 5% of programs ran out of funding, and this quite close to the end of the year, according to BriteSwitch.

As a likely result, a significant number of rebate programs offered accelerated rebates in the second half of 2023. One-fifth of programs, in fact. And some of these are continuing into 2024.

Softening demand for commercial lighting rebates appears to be related to LED saturation. In some regions, LED lighting’s success has led to saturation exceeding 50% of the installed lighting base. Market research conducted by utility consulting firm DNV projected LED share of the linear ambient lighting market to be over 70% in Connecticut, Massachusetts, New Jersey, and Rhode Island in 2023. As early adopters and the early majority have converted, the late majority and laggards are more difficult to capture.

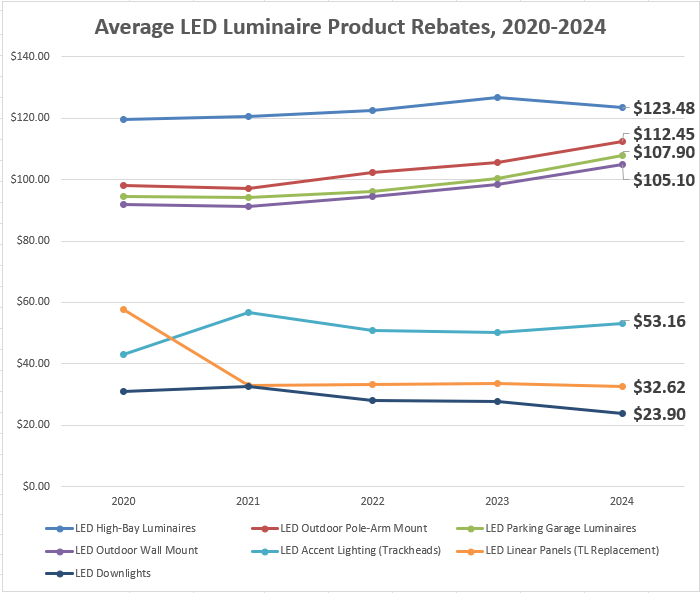

After stabilizing since 2021, LED product rebates are seeing a modest increase. As incentive programs stay current with the lighting market, they transitioned to LED technology, with steadily declining average rebates per product resulting from falling market costs in those early years. Average rebates subsequently stabilized, likely reflecting cost stabilization in the market.

In 2023, average rebates in some categories increased, possibly in response to rising material and labor costs. In 2024, this increase strengthened, potentially due to inflation, with an overall 2% increase for LED products as a whole. The highest average increases (6-7%) are for outdoor and parking garage luminaires.

rebate amounts per product for programs in the U.S. and Canada.

Data source: BriteSwitch RebatePro for Lighting rebate databe, February 2024.

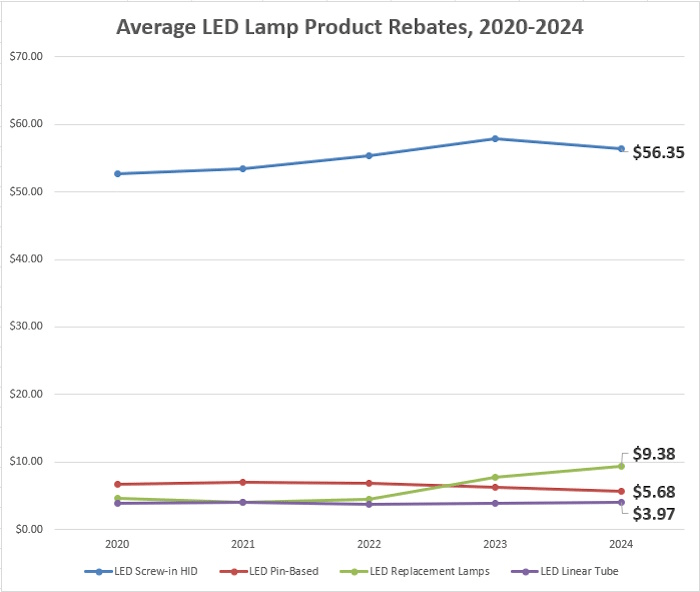

Despite Federal legislation eliminating traditional general-service, medium-base lamps, LED replacement lamp rebates surprisingly endured. In July 2023, the Department of Energy ruling on the Energy Independence and Security Act of 2007’s backstop energy standards took effect, which eliminated many traditional general-service lamps (e.g., A19 lamps) from the market. As a result, ENERGY STAR announced it is sunsetting its listing for many residential LED products. The average rebate for suitable LED replacement lamps saw a significant increase in 2023 as incentive programs staged a final push.

It was expected that these rebates would be eliminated in 2024 due to the DOE rulings and general market transformation to LED. While this occurred to a large extent, some smaller rebate programs continued them, and with higher average amounts, according to BriteSwitch. Again, this may have been due to these programs struggling to reach their energy savings targets.

rebate amounts per product for programs in the U.S. and Canada.

Data source: BriteSwitch RebatePro for Lighting rebate database, February 2024

Horticultural rebates continue to present a strong specialized category. In 2022, the number of rebates focused on horticultural lighting tripled, with many programs adopting a prescriptive instead of the custom approach. This growth stabilized in 2023.

In 2024, a significant number of programs are offering an incentive for horticultural lighting, with the average prescriptive rebate being about $100 per luminaire, according to BriteSwitch.

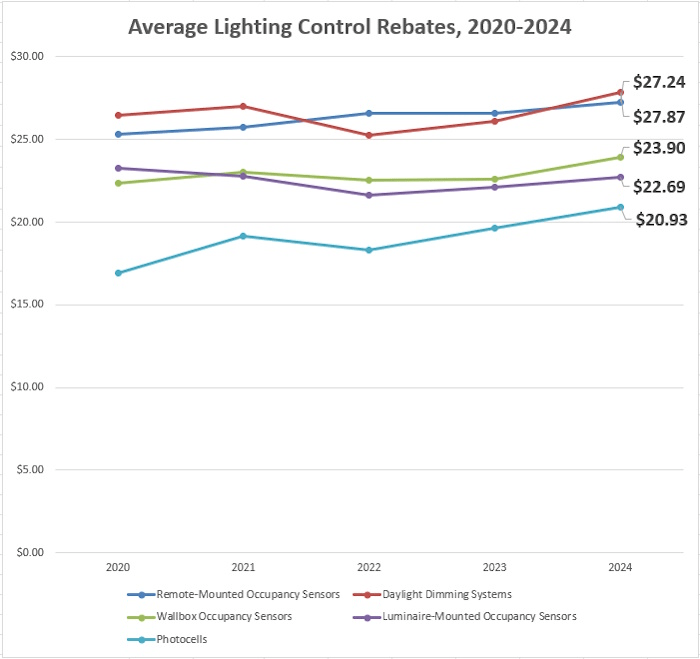

Lighting control rebates remain widely available and substantial, and they are increasing. In most of the United States, if a lighting rebate is available, one is available for controls as well. This continues to position lighting controls as an attractive upfront addition to a lighting upgrade.

Popular rebates include remote-mounted, wallbox, and luminaire-mounted occupancy sensors; photocells; and daylight dimming systems. In 2024, all of these categories are seeing an average increase of 2-7%.

with average rebate amounts per product for programs in the U.S. and Canada. (Networked control systems are not included,

as programs are still relatively unstandardized.)

Source: BriteSwitch RebatePro for Lighting rebate database, February 2024.

Network lighting control rebates are showing signs of standardization. Networked lighting controls are intelligent systems in which devices are connected within a network to enact control strategies. The flexibility of this type of system can produce substantial energy savings, making it attractive for adoption by rebate programs, while availability of data can produce non-energy benefits.

Traditionally, rebate programs treated networked controls as a custom option, but in recent years, a significant number of prescriptive rebates became available. This coincided with a new DesignLights Consortium (DLC) Qualified Products List for Networked Lighting Controls, used by a majority of prescriptive programs to qualify systems as being eligible for rebate.

According to BriteSwitch, the number of utilities incorporating incentives for networked lighting controls grew by 8% in 2024, with about 53% of these rebates being prescriptive, which is a more channel-friendly type of rebate than custom rebates. Additionally, most are now established on a per-luminaire basis, with an average of $211 per luminaire installed and controlled. It is also interesting to see 2% of networked lighting control rebate programs offered as midstream/instant rebates.

Commercial lighting rebates may evolve to accommodate the coming LED era. As LED saturation increases, rebates are likely to evolve to enable energy efficiency programs to continue to derive substantial energy savings from this category where possible.

In the future, commercial lighting rebates may shift to favor higher-efficiency LED lighting, targeting first-generation with current-generation LED technology (potentially seeing a $/W rather than a per-product rebate), lighting redesign approaches, more strongly tying lighting and controls as a package, networked and luminaire-level lighting controls, HVAC integration, and specialized applications such as UV disinfection, data, and tunable lighting. As lighting controls are underutilized in existing buildings, they are likely to play a strong role.

Looking at networked lighting controls alone, the DLC estimated that widespread adoption could reduce average lighting energy consumption by half. In 2023, the DLC published a study that underscored the energy savings potential of networked controls and recommended revising energy efficiency incentive models to capture the full benefits of controlled lighting, including pairing with HVAC systems in large buildings.

Getting rebates

Rebates take time and effort, but the results can be lucrative as they offer a potentially substantial sweetener for lighting and control upgrade proposals.

Consider rebates. First and foremost, evaluate the potential impact of rebates on your sales and include them in proposals if they make sense for your project.

Get to know applicable programs. Research and stay on top of rebate programs where you do business. Some manufacturers offer support in identifying rebate programs. Get educated on the process, requirements, and the amount of time that various steps require from pre-approval to receiving the check.

Manage risk. Understand that rebate applications may not be approved or may award a smaller amount than expected. The customer should be educated so they have appropriate expectations. Be sure to properly complete all required paperwork to expedite the process and maximize success.

After approval, keep abreast of the program, including policy changes. While many programs saw a softening of demand in 2024, it is still possible in some regions that strong participation may drain funds early. Note that some programs maintain a “reservation of funds” policy, which sets asides funds for approved projects working through the process.

Pre-approval is often required. The rebate program may require an application that must be approved before installation begins. This may ask for information such as description of the existing lighting, hours of operation, and square footage. Note that some programs have automated the application process, requiring familiarization with web-based forms.

Select qualified products. Many rebate programs require that qualified products be installed, basing their qualification on listing in the DLC’s Qualified Products Lists (solid-state lamps/retrofit kits/luminaires, horticultural lighting, and networked lighting controls). Standard lighting controls generally require minimal qualification beyond core function.

Inspection may be required. Onsite (or virtual) inspection may be required to verify product installation. Certain documentation detailing the installation may be required. Some programs may require measuring and monitoring to capture and validate energy savings.

Put rebates to work

For decades, commercial lighting rebates have offered a powerful incentive for buildings owners to adopt energy-efficient lighting and controls. While rebates can require effort and pose a degree of risk, numerous building owners have tapped them to help fund installation of new lighting and controls.

The overall outlook for commercial lighting rebates in the U.S. in 2024 is very strong, with widely available rebates supported by freely available, detailed listings of qualified products. They are particularly attractive for projects involving solutions adding lighting controls, including networked lighting controls. While capturing lighting upgrade projects may be more challenging as LED saturation increases, rebates can be even more critical to convert this business.

Published with the permission of the Lighting Controls Association. First published here